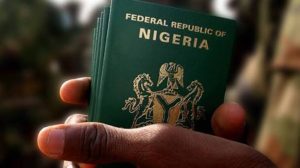

U.S. prosecutors in the Southern District of New York have secured a guilty plea from Chibundu Joseph Anuebunwa, marking the third Nigerian man involved in a widespread business email compromise (BEC) ring in the mid-2010s. Anuebunwa, 40, admitted to participating in a wire fraud conspiracy, according to U.S. attorneys. Alongside two co-defendants, Anuebunwa orchestrated fraudulent activities that resulted in the loss of over $25 million from thousands of victims worldwide between 2014 and 2016, as previously stated by prosecutors.

David Chukwuneke Adindu, also implicated in the same case, received a prison sentence in 2017, while Onyekachi Emmanuel Opara was sentenced in 2018 on similar charges.

The BEC scheme followed a familiar pattern, with the fraudsters sending emails to employees of various companies, posing as legitimate requests for funds to be transferred to specific bank accounts. These emails often appeared to be from supervisors or third-party vendors associated with the targeted companies. In many cases, employees failed to notice slight discrepancies in the sender’s address or altered message metadata, which gave the illusion of legitimacy, as noted by prosecutors. Once the money was deposited into the designated bank accounts, the scammers swiftly transferred the funds out of reach.

Anuebunwa is scheduled to be sentenced on October 2, as per prosecutors. Initially apprehended in the United Kingdom, he was subsequently extradited to the United States in May 2022.

Recent months have witnessed other notable cases involving alleged Nigerian BEC rings, attracting significant media attention. In April, one defendant was extradited to the U.S., and in November 2022, a Nigerian influencer received an 11-year prison sentence as part of a BEC-related case. Concurrently, cybersecurity experts raised concerns about a ring referred to as Lilac Wolverine during the same month.

As law enforcement continues to combat the escalating threat of BEC scams, the guilty plea from Anuebunwa adds to the growing list of convictions and serves as a reminder of the ongoing efforts to protect individuals and businesses from falling victim to such fraudulent schemes.

0 Comments