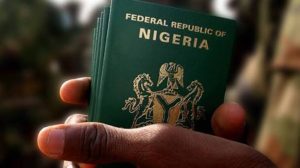

As reported by Bloomberg, the Central Bank of Nigeria is grappling with challenges in meeting the surging corporate and individual demand for the US dollar, resulting in a continued depreciation of the Nigerian naira. This depreciation led to the naira plummeting to new lows of N1,030 on the black market on Wednesday, October 11, and further declined to N1,045 during the day.

The disparity between the official and unofficial exchange rates has widened considerably, with the official rate standing at 765.8 dollars per unit on the FMDQ OTC trading platform.

Despite Nigeria’s move to expand currency exchange options in June as part of efforts to attract foreign investment and bolster the nation’s economy, there remains persistent pressure on the local currency to depreciate. It’s worth noting that the Central Bank of Nigeria had eliminated all exchange rates, including those of the black market.

Abubakar Mohammed, the CEO of Forward Marketing Bureau de Change Ltd., a firm that compiles data on the informal market in Lagos, reported that the naira fell from N1,015 per dollar the previous day to N1,030 per dollar on Wednesday. Statistics from the country’s office also revealed a 33% decline in capital inflows in Nigeria, reaching $1 billion in the three months leading up to June, primarily attributed to investor concerns regarding capital controls and the sluggish economy.

The central bank’s data revealed that external reserves dropped to $33.2 billion, the lowest level in two years. Umar Salisu, a foreign-exchange operator in Lagos, said:

“People are looking for dollars, both the seller and the buyer. Until there’s enough supply, you can’t predict the exchange rate.”

Addressing the decline in external reserves, financial analyst Samuel Oyekanmi pointed out that Nigeria’s reserves have been impacted by the reduced volume of exports, resulting in a decrease in foreign exchange (FX) inflows.

He further noted that Nigeria’s heavy reliance on imports entails continuous FX expenditure on import-related expenses, a factor clearly reflected in the state of the country’s reserves.

Highlighting the significance of a robust external reserve for the nation, Oyekanmi emphasized:

“A country always wants their external level to increase because it is one of the ammunitions that the CBN uses to defend the exchange rate. So if you have it low, it means you don’t have enough firepower to defend the exchange rate when you need to.”

In the first half of 2023, the Central Bank of Nigeria (CBN) expended more than $5 billion in efforts to preserve the stability of the naira within the foreign exchange market.

Despite the CBN’s commitment, the settlement of foreign exchange obligations, amounting to over $10 billion owed to Deposit Money Banks, remains pending more than two weeks after the initial announcement.

In contrast, Bureau de Change agents in Lagos, Abuja, and Kano observed a continuous depreciation of the naira against the US dollar and other foreign currencies during Friday and Saturday.

It is noteworthy, however, that the naira exhibited a slight strengthening on the Investor & Exporter FX window on Friday, September 22, 2023, with an exchange rate of 747.76 per US dollar, as opposed to the previous day’s rate of 772.98 per US dollar.

0 Comments