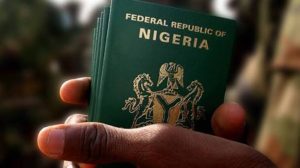

The Nigerian Interbank Settlement System (NIBSS) has reported that over 2.021 million bank accounts were closed in the first quarter of 2024 (Q1’24).

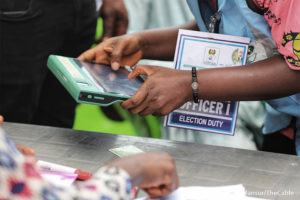

This action follows a regulatory directive issued by the Central Bank of Nigeria (CBN) to all commercial banks in the country. The directive mandates the restriction of tier-1 accounts lacking proper Biometric Verification Number (BVN) and National Identity Number (NIN) that are not linked by Thursday, March 2nd, 2024.

According to the NIBSS, while the number of inactive bank accounts increased month-on-month (MoM) by four million to 19.7 million in March, up from 19.3 million in February 2024, active bank accounts saw a rise of 6.62 million or 3.0 per cent, reaching 219.64 million from 213.02 million in February.

The report also reveals that approximately 61.6 million Nigerians possessed BVNs as of April 2024.

A bank account is classified as inactive if it registers zero transactions, including deposits, withdrawals, transfers, or point-of-sale transactions, for six consecutive months.

0 Comments