To advance financial inclusion and promote financial literacy, the Central Bank of Nigeria (CBN) has unveiled the “SabiMONI” e-learning platform.

The goal of SabiMONI, a fully digital national e-learning platform that offers a knowledge base for financial literacy, is to support CBN’s efforts to increase the number of experts that can be used to spearhead financial education in the nation.

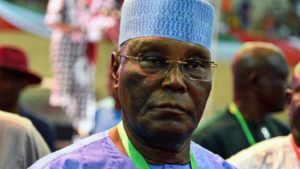

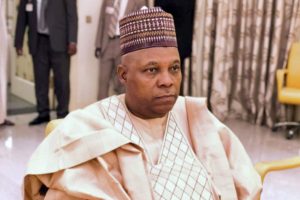

According to CBN Governor Godwin Emefiele, the introduction of the SabiMONI e-Learning platform will help people have the chance to receive training and become Certified Financial Literacy Trainers (CFLT) through self-service.

“One of the key drivers of Financial Inclusion today, is no doubt financial literacy. It is a prerequisite for greater financial inclusion, which would lead to the stability of the financial system and ultimately economic growth and development.

“Research has shown that the absence of or low levels of financial literacy constitutes an impediment to financial inclusion. In other words, the pace of financial inclusion is directly related to the level of financial literacy and financial capability (National Financial Literacy Framework),” he said.

Emefiele pointed out that the National Financial Inclusion Strategy 2022 identifies expanding digital financial services and platforms as one of its strategic priority areas in addition to increasing adoption and usage of financial services in priority demographics comprising the most vulnerable segments, including women, youth, MSMEs, rural residents, and especially the Northern region of the country.

“To enable us to achieve these, we must take deliberate steps to upscale financial capability through financial education programmes. The shortage of skilled and experienced persons to drive financial education remains a major hindrance.

“There is no gain in saying the fact that the SabiMONI Financial Literacy e-Learning Platform will enable us to drive financial education physically through the certified financial literacy trainers at the locations where it is most needed. As a result, consumer confidence in the adoption and use of digital financial services will increase. It will allow us to promote digital financial literacy.

“The SabiMONI portal will serve as a repository of information not only for learners but also for researchers in the most effective manner,” he added.

Financial inclusion, according to Emefiele, is a powerful tool for reducing income disparity, battling poverty, upholding social harmony, and ultimately ensuring financial system stability.

He exhorted everyone to take advantage of the fantastic chance to enrol in the SabiMONI e-learning platform, take the courses, and encourage other people to use the platform and learn how to better manage financial resources.

The CBN Governor emphasised the significance of making sure that the efforts have a positive impact on financial capability, financial health, and financial inclusion. He also charged the populace with seeing that a practical measurement and evaluation framework is put in place so that everyone can evaluate the impact of not only the SabiMONI but also other financial literacy initiatives.

Financial literacy continues to be a key factor in driving financial inclusion globally, according to Mrs. Rashida J. Monguno, Director of Consumer Protection, Central Bank of Nigeria, who gave opening remarks at the event. She noted that financially literate consumers are always able to make better financial decisions, which is a catalyst for greater financial inclusion and stability of the financial system.

0 Comments