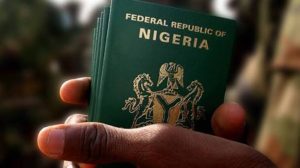

The Central Bank of Nigeria (CBN) has once again raised the Customs duty exchange rate to N1,605.82/$1, marking yet another increase in a series of adjustments. This comes less than five days after a slight reduction from N1515.48 to N1472.756/$1. The updated rate, already visible on the Customs portal as of February 21st, 2024, has further dashed the hopes of customs brokers and importers who were anticipating a relaxation from the Central Bank.

This move follows the recent plea by the National Assembly for caution in raising customs duty exchange rates. Customs brokers express concern, stating that the frequent rate hikes have had adverse effects on their businesses and trade volumes. Importers are reported to be abandoning goods at ports, with some redirecting their shipments to neighboring countries’ ports.

Remarkably, the apex bank has adjusted the customs duty exchange rate over five times within a single month this year. In response to this situation, Peter Obi, the presidential candidate of the Labour Party, has called on the Federal Government to halt the continuous surge in customs duty charges. Obi, in a statement posted on his verified X (formerly Twitter) handle, emphasized that the inconsistency in duty charges negatively impacts the overall business environment in the country.

He cautioned that if this trend persists, importers might opt for ports in nearby countries, resulting in reduced productivity at Nigerian ports and exacerbating economic challenges due to a decline in revenue.

Obi said, “I wish to urgently call on the Federal Government of Nigeria to end the inconsistency in duty charges as it is affecting the general business atmosphere in the country.

“The federal government should stop the arbitrary and ever-increasing customs duties as it is now negatively impacting businesses and the cost of items, and this portends a huge danger to the economy.

“A situation where at the point of initiating importation, Form M and other documents related to importation are based on a particular rate of exchange, for example, N1000 to $1, being the prevailing exchange rate at the time which the importer of goods was used to calculate the entire process, from the import initiation to receipt of goods in his warehouse.

“Then suddenly when the goods arrive in Nigeria, and duties are calculated at different rates, say N1400 to $1, it becomes a serious business challenge that results in business losses.

“Worse still, it directly fuels the inflationary spike which is the basis of increasing cost of goods and living. Such arbitrary charges will obviously lead to further closure of businesses, and attendant job losses.

“This is because at the time of the initiation of the business, calculations, including duties, have been made based on the prevailing exchange rate, and the prevailing market prices.

“If this situation is not corrected, our importers may resort to using ports of nearby countries, a situation that will leave our ports under-productive, and further deepen our economy into a worse situation as a result of loss of revenue.”

0 Comments