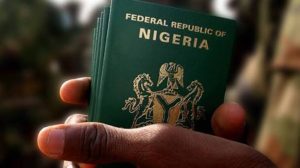

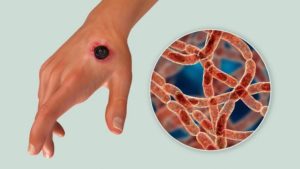

Following directives from the Central Bank of Nigeria (CBN) regarding the cybersecurity levy, PoS operators are required to register their agents, merchants, and individuals.

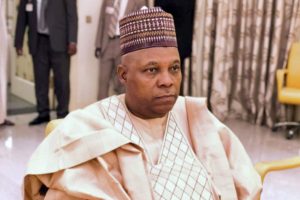

This suggests that Nigerians may soon encounter increased charges for PoS transactions. The Corporate Affairs Commission (CAC), under the leadership of registrar-general and CEO Hussaini Magaji, has set a two-month deadline for PoS operators to comply with registration requirements.

However, this mandate has sparked protests from some operators who fear it will lead to higher charges for their customers. In response, the CAC has established a center for the “bulk registration” of operators, with Magaji emphasizing its role in facilitating requests from fintech industry players who voluntarily submit their agents and merchants for regularization.

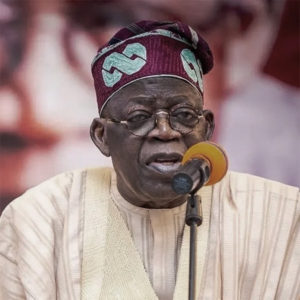

Magaji noted that this initiative aligns with President Bola Tinubu’s commitment to promoting financial inclusion for youth and combating fraud and financial crimes. The registration effort, which follows an agreement between the commission and fintech firms, has faced opposition from operators concerned about increased costs and reduced profits.

Some agents in Abuja voiced concerns to the News Agency of Nigeria, suggesting that the registration fees would ultimately affect transaction costs for customers and discourage new entrants into the business.

“I know that this registration when actualised by our operators will increase the amount they charge us.

“This means that the cost we charge on each transaction will increase, so our customers will bear the cost,’’ he said.

Another PoS agent, Mr Clement Agbasi, said the directive negated the financial inclusion initiative of the CBN.

Agbasi said that directive would cause many customers to save their cash at home rather than being charged heavily for their online transactions.

“The PoS business was geared toward bringing the banks closer to the unbanked and making it easier for them.

“With all these charges including the 0.5 per cent cyber-security levy on customers, many people will be discouraged from putting their monies in banks,’’ he said.

0 Comments