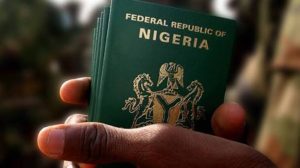

A new initiative to encourage compliance and boost tax income calls for harmonising the numerous levies levied by the three government divisions.

At a meeting with the heads of the state internal revenue boards this afternoon in Abuja, the chairman of the Joint Tax Board (JTB), Mr Muhammad Nami, revealed this.

The focus of the meeting was “Harmonisation and codification of taxes at the National and Sub-national levels: Crucial to developing a tax-friendly environment in Nigeria.”

He claimed that his team was going from the level of debate to the implementation of the desperately needed tax harmonisation in the nation.

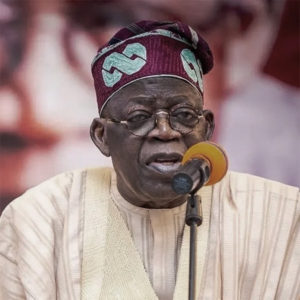

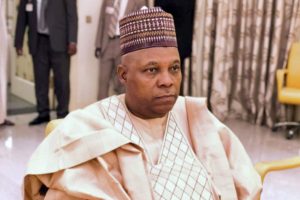

According to Mr Nami, President Bola Tinubu was adamant about taking the appropriate actions to urge more Nigerians to comply with their tax commitments.

His words, “We have moved from just talking about harmonising the various taxes. We are now at the level of actual harmonisation. President Tinubu is very serious about addressing the problem of the multiplicity of taxes.

“I have addressed the State Governors at the National Economic Council, and we have all agreed that it is better to harmonise the taxes, have fewer taxes and effectively collect them by encouraging taxpayers to comply.

“As the new administration attempts to address the many socioeconomic challenges facing the nation on many fronts, it becomes imperative for all levels of State to shake off any lethargic antecedents and focus on the goal of a national resurgence.

“The unique and privileged offices we occupy as drivers of the nation’s tax administration processes present us with a rare opportunity to take hard, but necessary decisions that are expected to yield long-term benefits and add immense value to our collective prosperity as a nation.

“In recent years, especially since the dawn of our current democratic dispensation, the importance of taxation has continued to be reiterated and reinforced by all, and the critical role that tax revenue plays in funding government and governance cannot be overemphasised.”

The Federal Inland Revenue Service (FIRS), whose chairman is Mr. Nami, stated that it would safeguard small enterprises while ensuring that those operating in the unorganised sector paid taxes.

He made it clear that companies with a turnover of less than N25 million were exempt from paying taxes.

Earlier, Mr. Taiwo Oyeleye, the chairman of the Presidential Fiscal Policy and Tax Reforms Committee, emphasised the necessity of dramatically reducing the amount of taxes placed on Nigerian citizens and enterprises.

He emphasised that many taxes were to blame for the nation’s low tax morale, discouragement of investments, facilitation of corruption, and difficulty in conducting business.

According to him, “Many MDA (Ministries, Departments and Agencies) Specialised Purpose vehicles are set up and allowed to collect taxes and taxes are building up every day.

“Last year alone, there were four new taxes. My team did a study and found out that there were 44 bills in the works at the National Assembly with various types of taxes.”

Mr Taiwo observed that imposing multiple taxes always led to low tax morale among the populace and that many business owners saw the government’s imposition of many taxes against their companies.

Strangely, he continued to see the amount of tax income collected decrease as the number of taxes increased. Many Nigerians pay taxes that are not collected by the government. Taxes must be paid by businesses out of their capital. The fastest way to destroy such firms is by doing that.

The tax expert compared the tax revenues of Nigeria and South Africa and came to the conclusion that the latter’s tax revenues were far higher than what Nigeria received annually, despite the fact that the latter’s administration was much larger.

0 Comments