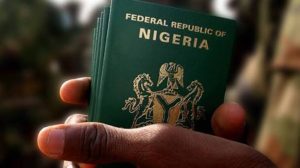

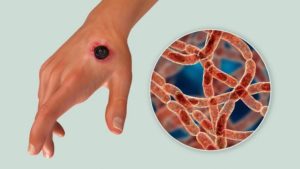

Nigeria has been identified as one of the least favorable global destinations for investors, primarily due to its low governance ratings as per the latest World Economic Governance Index.

The rating agency recently assigned a D grade to Africa’s largest economy, indicating subpar governance and placing it slightly below economically challenged nations such as Lebanon, Syria, and Yemen. In the World Economic Governance Index, Nigeria secured a ranking of 40.8, with specific scores for rule of law at 30.9, press freedom at 52.1, political rights at 53.5, and corruption at 26.7.

Countries scoring below 100 are deemed to have poor governance, while those surpassing 100 are considered to have high governance indicators.

“Don’t invest in countries with poor governance. They can cost you billions and expose you to legal and political troubles,” the World Economic Governance report said.

This occurrence, coupled with numerous other challenges, has deterred foreign investors from engaging with Africa’s most populous nation.

Concurrently, smaller African countries, in comparison to Nigeria, are luring investors with more attractive offerings, gaining a competitive edge over the “giant of Africa” in the race to attract investment.

In the most recent Rule of Law Index for 2023 released by the World Justice Project, Nigeria is positioned at 120th out of 142 countries and ranks 23rd among 34 nations in Sub-Saharan Africa concerning adherence to the rule of law.

Leading countries in the Sub-Saharan region, surpassing Nigeria, include Rwanda, Namibia, Mauritius, Botswana, South Africa, Senegal, Ghana, Malawi, The Gambia, Benin, Burkina Faso, Tanzania, Kenya, Togo, Zambia, Ivory Coast, Niger, Sierra Leone, Liberia, Madagascar, Angola, and Guinea.

The World Justice Project report utilized eight key indicators to evaluate countries’ performance, encompassing constraints on government powers, absence of corruption, open government, fundamental rights, order and security, regulatory enforcement, civil justice, and criminal justice.

“Nigerians will pay the ultimate price of the country becoming less of an investment destination, particularly in the form of jobs. For a country whose population will surpass that of the United States by 2050 to become the third most populous nation globally, jobs are critically needed,” Charles Akinbobola, analyst at Sofidam Capital, said.

He added: “This minute, you are in business in Nigeria, and the next minute you could be out by the stroke of the pen of a clueless government official who seeks to protect his ego more than the jobs of thousands of people.

“Other times a government policy is enough to frustrate foreign investors and send them packing. The upside for these investors is that there are growing options in other African markets”.

In August, GlaxoSmithKline (GSK), a British multinational pharmaceutical and biotechnology company, revealed its intention to withdraw from Nigeria, marking the end of its 51-year presence in the country. GSK’s departure has been anticipated for some time and aligns the healthcare company with a growing roster of foreign firms that have disengaged from Nigeria.

This list includes Shoprite, a South African retailer, Etisalat, a telecommunications company based in Abu Dhabi, and the UK-based Intercontinental Group.

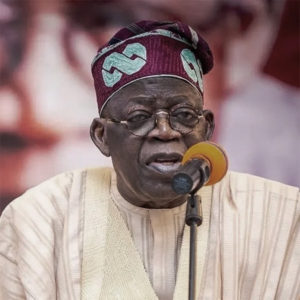

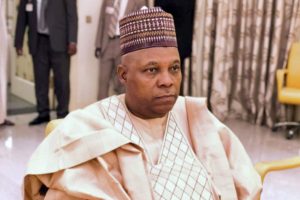

The exit of yet another multinational corporation further complicates President Bola Tinubu’s efforts to attract foreign direct investment (FDI).

Foreign Direct Investment (FDI) inflow into Nigeria has experienced a notable decline in recent years, reaching a 10-year low in 2022. The total FDI in the first quarter of 2023 amounted to a mere $48 million, marking a significant 69 percent decrease from the $155 million reported in the same period of 2022.

In March, Unilever’s Nigerian subsidiary announced its decision to cease the production of homecare and skin-cleansing products, aiming to enhance the competitiveness and profitability of its business. Unilever faced a foreign exchange loss of N14.36 billion in the second quarter of 2023, a notable increase from the N1.06 billion recorded in the first quarter. The company attributed this revaluation loss to foreign currency-denominated balances associated with trade loans.

0 Comments