There are compelling indications that if the ongoing conflict between Israel and Hamas continues, Nigerians could experience economic repercussions in the coming days. The global oil market has witnessed a surge in prices since the onset of this conflict due to concerns that it could disrupt energy production in the Middle East. This crisis has resulted in a significant loss of life, with approximately 2,000 casualties on both sides.

In what seems to be a resurgence of hostilities, Hamas from Palestine has launched attacks on Israeli homes and public spaces, including a festival gathering, resulting in the tragic deaths of over 900 individuals. In response, Israeli forces have carried out retaliatory airstrikes on Gaza, a densely populated area housing over two million Palestinians and the Hamas leadership, causing around 700 casualties thus far.

Within the context of this conflict, the global benchmark Brent Crude oil price surged by 4.2 percent to reach $88.15 per barrel on Monday, while the US benchmark, West Texas Intermediate, increased by 4.3 percent to $86.38 per barrel, as reported by Al Jazeera. While both Israel and Palestine are not major oil producers, the markets have been rattled by concerns that the ongoing crisis could lead to broader instability in the Middle East, home to some of the world’s largest oil-producing nations, including Iran and Saudi Arabia.

Notably, a rise in crude oil prices, coupled with the sharp depreciation of the Naira against the US Dollar, has resulted in higher costs for imported refined petroleum products in Nigeria. This situation persists as local refineries remain non-operational. Experts caution that a further increase in crude oil prices due to the Israel-Hamas conflict could lead to an upward adjustment in the pump price of Premium Motor Spirit, commonly known as petrol, in Nigeria. This would compound the widespread economic challenges facing the nation.

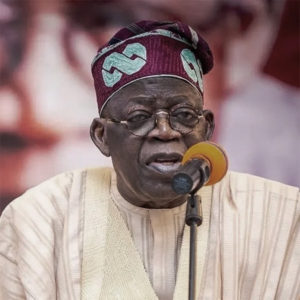

At present, petrol is selling at prices ranging from N568 to N620 per litre, a significant increase from the N480 to N520 per litre observed before President Bola Tinubu’s announcement of subsidy removal during his inauguration on May 29. This announcement led to a sharp surge in fuel prices from N187 to N190 per litre.

“If the price is going up in the international market, it will affect the pump price, since we are importing,” a seasoned economist, Professor Sheriffdeen Tella, said.

With food prices and transportation costs continuing to soar, millions of Nigerians have been severely impacted by the removal of subsidies. The effects are being felt in all areas of the economy, and among other things, this has resulted in higher tuition costs, particularly for private schools.

“If the war lingers, it will affect us shortly, not in the long run because those who are selling to us will sell at whatever price the international market dictates. The government will have to look for a way to cushion the effects,” Prof Tella warned, adding that “we should pray for the war to end in time.”

“Neither of the two (Israel and Palestine) are producing oil, but they have a role to play because all these things are linked together as they are supply routes. The price has been rising partly due to that war.

“If the NNPC has some reserve, that could assist, but if it doesn’t it will affect us in the short-run. It is either the domestic price (pump price) will rise or the government will have to pay some subsidy,” he said.

Prof. Leo Ukpong, a Financial Economics professor at the American University of Nigeria in Yola, asserted that the conflict would bring about both immediate and consequential impacts on the Nigerian economy, with a particular focus on the crude oil market.

He said, “If the oil producing countries around the Middle East, such as Iraq, Kuwait, Saudi Arabia, and Qatar, are drawn into the war, global oil prices will likely spike upwards. Increase in oil price will benefit Nigeria in the sense that our foreign reserve will experience an increase, everything else held constant.

“However, since Nigeria depends on import for refined oil products (petrol, diesel, kerosine, jet fuel, etc.), the increase in global crude oil prices will also lead to an increase in the price of these refined products and manufactured goods. In turn, the increase in refined crude products will likely wipe out any benefit we should have enjoyed from the rise in crude prices.

“When our high foreign debt servicing bills is factored into the picture, I doubt Nigeria’s economy will derive any net positive benefit from a rise in crude oil prices because of this war. Based on our recent past experiences, it is more likely that our economy would experience a net negative benefit.”

The professor emphasized that unless Nigeria develops its refining capacity to meet domestic demand for processing crude products, the country will struggle to reap the benefits of rising global oil prices.

Apart from the looming possibility of oil price increases, concerns are growing that the ongoing crisis could disrupt international flights, including those to and from Nigeria. On Monday, the Lagos State Government suspended the departure of the second batch of prospective pilgrims who were scheduled to be flown to Israel on Tuesday.

Mrs. Florence Gbafe, the Board Secretary of the Lagos State Christian Pilgrims Welfare Board (LSCPWB), made the announcement in a statement, citing a careful assessment of the security situation in Israel as the reason for the suspension. She stated, “To all those in the second batch of pilgrims to Israel, please be informed that the pilgrimage is currently on hold due to the war situation in Israel. Further information will be provided when appropriate.”

Although flights between Nigeria and Israel have not been disrupted, as Ethiopian Airlines and Qatar Airways continue to operate flights to Tel Aviv Airport in Israel, there is a foreseeable reduction in flight frequencies.

“People still go to where they want to go and do what they want to do where there are no problems and come back. That is why there has been no announcement of flight cancellations to Israel. It is only when it gets to the extent that all their borders are closed that they cancel flights. If their border is not closed, flights will still go.

“The only thing that would happen is that they may reduce frequency because people will have reservations about travelling. If this happens, traffic will reduce and airlines will reduce frequencies,” the President of the National Association of Nigeria Travel Agencies, Susan Akporiaye, said.

0 Comments