Major international corporations, such as Procter & Gamble Co. (P&G), GSK Plc, Bayer AG, and Sanofi SA, have recently announced their departure from Nigeria, the continent’s most populous nation and second-largest economy. The exits are attributed to difficulties in accessing dollars for repatriating earnings, exacerbated by currency devaluations, unreliable electricity supply, and port congestion.

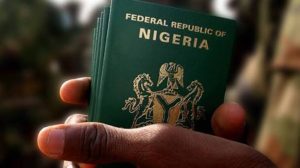

According to Bloomberg, this exodus highlights broader economic issues, including policy missteps, corruption, and an overreliance on oil. Dollar scarcity has resulted in a backlog of demand for foreign exchange, impacting companies’ debt payments and raw material imports. The Central Bank of Nigeria’s two recent naira devaluations within eight months have further intensified economic pressures, causing an 86% depreciation over the last eight years.

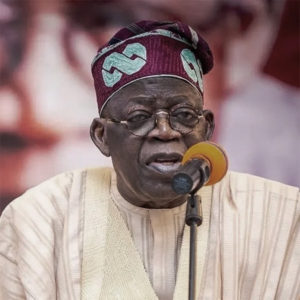

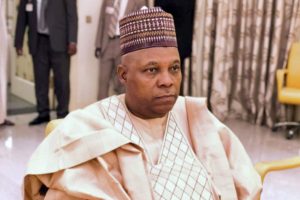

Nigeria’s $394 billion economy heavily relies on oil, and the departure of these major corporations could worsen existing economic challenges. President Bola Tinubu, in office since May, has implemented policies to revive the economy, simplify taxes, establish a committee to reduce red tape, and improve infrastructure. However, experts anticipate that these measures will take time to yield results.

The corporate exits raise concerns about Nigeria’s business environment and its impact on the local workforce. Economic challenges have also affected other companies, with PZ Cussons Plc revising profit expectations downward, Cadbury Nigeria Plc converting loans to equity due to currency constraints, and Nestle and Unilever continuing operations amidst broader economic uncertainties.

0 Comments