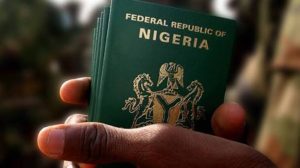

As the Nigerian currency faces relentless depreciation against the US dollar and other major currencies, citizens and businesses are grappling with the economic fallout. On January 26, Nigeria’s currency fell to a record low of N1,416 per dollar at the parallel market following strong demand amid shortage as traders hoard the available dollars.

This indicated a 15.19 per cent depreciation year-on-year when compared to N1,200 at the beginning of the month.This downward spiral poses challenges for individuals and uncertainties for businesses, calling for decisive actions from key figures.

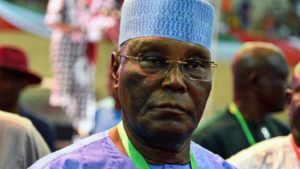

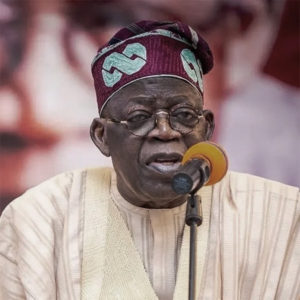

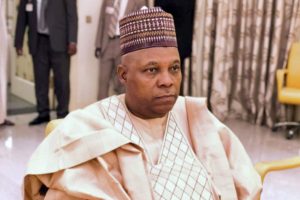

President Bola Tinubu, Finance Minister Wale Edun, and CBN Governor Olayemi Cardoso find themselves at the forefront of addressing this economic concern. Efforts must intensify to restore the naira’s value and alleviate the hardships faced by the population.

The naira’s troubles began last June when the CBN, following Tinubu’s directive, initiated the unification of the naira rates, relinquishing control of the forex market. Market forces have since determined the exchange rate, leading to a rapid devaluation. Despite recent support from AfreximBank and claims of improved forex obligations clearing, the naira’s depreciation persists.

Tinubu’s goal of narrowing the gap between parallel and official market rates is yet to materialize, with the spread widening to around N400 on January 23. Despite promises of measures to boost the naira, rates have hovered between N1,170 to N1,200 in recent months.

The unification of naira rates appears more artificial than effective, lacking the necessary economic fundamentals. Projections from The Economist Intelligence Unit and KPMG suggested challenges with managing monetary policy under a float and emphasized the importance of decentralizing the forex supply environment.

To bolster the naira, the government must reduce governance costs, implement effective monetary policies, and initiate the privatization of key sectors. Addressing the electricity crisis, attracting investors, and promoting business ease are crucial steps.

Additionally, curtailing excessive government borrowing, intensifying local production, and supporting Small and Medium Scale Enterprises can contribute to stabilizing the economy. The road to restoring the naira’s value demands a comprehensive strategy that embraces both short-term and long-term measures.

0 Comments