The Nigerian Communications Commission (NCC) has warned Nigerians about a new threat posed by electronic fraudsters who are now targeting telecommunications networks to disrupt service delivery in order to carry out their illicit practices.

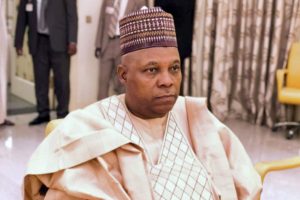

This warning was given by Prof. Umar Garba Danbatta, executive vice chairman of the Commission, on Wednesday at a Consumer Protection and Advocacy Program held in Kofar Goriya, Keffi, Nasarawa state. He referred to the country’s increase in electronic frauds as alarming and cautioned citizens about falling victim to fraudsters’ tricks.

Danbatta was represented at the event by Mr. Clement Omife, Head of Consumer Protection and Advocacy Unit, with the theme “Shine your eye, don’t fall mugu.”

He emphasized that information from the CBN showed that e-fraud in Nigeria remains the biggest risk at the moment and advised citizens to avoid opening suspicious e-mail messages or responding to unfamiliar online inquiries.

He further stated that in cooperation with the NCC, the Economic and Financial Crimes Commission (EFCC), the Independent Corrupt Practices and Other Related Offences Commission (ICPC), the Nigeria Police Force, and the Central Bank of Nigeria have expanded their mandates to combat electronic fraud.

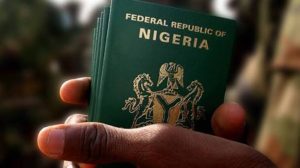

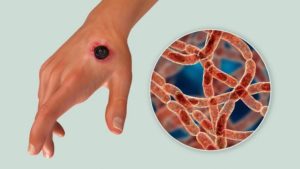

According to Danbatta, cybercriminals also access people’s data banks through SIM swaps and Unstructured Supplementary Service Data, or USSD, in order to engage in nefarious activities.

He said, “As the telecom industry evolves, there is a growing concern over the rising trend of fraud on telecom (electronic fraud) across sectors of the Nigerian economy.

“The menace which follows wide acceptance of new methods of mobile money and electronic banking and payment systems has been discovered to cost the country whopping sums of money.

“The Central Bank of Nigeria (CBN) rates electronic fraud as the biggest risk in the sector which has widely incorporated electronic payment solutions such as Automated Teller Machines (ATMs), Nigeria Inter-Bank Settlement System (NIBBS) Instant Payment and mobile banking.”

In order to combat e-fraud and ensure the security and integrity of the telecoms industry in relation to the country’s financial system, he emphasized that ongoing consumer advocacy and education campaigns are being conducted worldwide.

“Attackers are now targeting telecom networks with the intent to disrupt service delivery and infiltrate their data bank SIM swaps and Unstructured Supplementary Service Data, USSD e-payment frauds, are currently some of the serious cyber threats in the telecom industry.

“Fraudsters conduct SIM swaps of individuals and then conduct USSD-based transactions which cost victims huge losses.

“A lot of people are highly ignorant to how losing their phones to fraudsters can lead to a complete clean-up of their bank accounts. These fraudsters do this by stealing victims’ identities; name, address, bank information.

He advised consumer to be careful not to open unfamiliar email or respond to unfamiliar inquiries and to report suspicious E-fraud to their respective banks and telecom service providers.

0 Comments