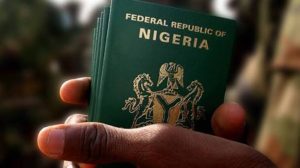

An official from the Nigerian National Petroleum Co. Ltd. (NNPC) has highlighted that the ongoing conflict between Russia and Ukraine is affecting the entry of Nigerian crude oil into the global market.

This impact is attributed to a decrease in demand in the historically reliable Asian market due to the war. During a panel presentation at the Argus European Crude Conference in London, Maryamu Idris, Executive Director for Crude and Condensate at NNPC Trading Ltd., noted that the conflict has created a situation where India, a major destination for Nigerian crude, has increased its preference for discounted Russian barrels, negatively affecting Nigerian volumes.

“To illustrate the extent of this shift, Nigeria’s crude exports to India dwindled from approximately 250,000 barrels per day (bpd) in the six months preceding the February 2022 invasion of Ukraine to 194,000 in the subsequent six months afterwards. And so far, this year, only around 120,000 bpd of Nigerian crude volumes have made their way to India,” she said, according to excerpts of her remarks relayed on the NNPC website.

On the other hand, she noted that the Nigerian crude flow to Europe has increased in a bid to fill supply gaps left by the ban on Russian crude, pointing out that six months before the war, 678,000 bpd of Nigerian crude grades went to Europe, compared to 710,000 bpd six months later and 730,000 bpd so far this year.

“This trend makes it evident that Nigerian grades are increasingly becoming a significant component in the post-war palette of European refiners. Several Nigerian distillate-rich grades have become a steady preference for many European refiners, given the absence of Russian Urals and diesel. Forcados Blend, Escravos Light, Bonga, and Egina appear to be the most popular, and our latest addition – Nembe Crude – fits well into this basket. This was a strong factor behind our choice of London and the Argus European Crude Conference as the most ideal launch hub for the grade,” Idris said.

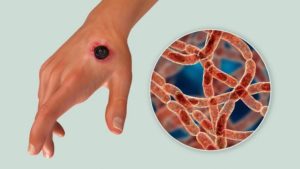

On production challenges, Idris remarked that, like many other oil-producing countries, Nigeria had faced production challenges aggravated by the COVID-19 pandemic, including reduced investment in the upstream sector, supply chain disruptions impacting upstream operations, aging oil fields and oil theft. These factors, she said, contributed to production declines in the second half of 2022 and early 2023, though adding that these are fast becoming a thing of the past.

According to her, this was visible in September 2023, when Nigeria recorded the highest crude oil and condensate output in nearly two years, at 1.72 million bpd.

0 Comments