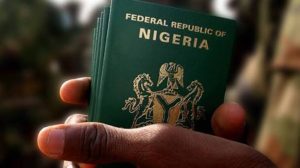

In a recent legal development, MTN Nigeria has lost its appeal case against the Federal Inland Revenue Services (FIRS) regarding a tax default order. The Lagos State division of the Tax Appeal Tribunal has ruled that MTN Nigeria must pay $72,551,059 in taxes for the period from 2007 to 2017, as mandated by the FIRS.

However, the tribunal has absolved the telecom company from paying an additional $21,039,807 in penalties and interest on the principal tax amount. The judgment was delivered by a five-man panel led by Prof. A. B. Hamed in response to an appeal (TAT/LZ/VAT/075) filed by MTN against the FIRS’s request for payment of the outstanding tax.

The legal dispute began with the Office of the Attorney General of the Federation (OAGF) conducting an investigation into MTN’s Forms A and M transactions covering the years 2007 to 2017. A revised report in August 2018 adjusted the alleged outstanding tax amounts, specifically for import duty and VAT, leading to the dispute.

FIRS subsequently conducted a review of MTN’s tax and accounting records and upheld the alleged tax liability. In July 2021, FIRS issued a VAT assessment of $93,590,366 to MTN, including the principal liability of $72,551,059 and $21,039,807 in penalties and interest.

MTN objected to the initial assessment, which led to FIRS reviewing and issuing a revised assessment of $135,697,755 in April 2022. The revised assessment reduced the principal tax liability to $47,776,210 but increased the interest and penalty to $87.900 million.

MTN formally objected to the revised assessment, and FIRS declined to amend it. Subsequently, MTN filed an appeal with the Tax Appeal Tribunal, which has now ordered the telecom company to pay the principal tax amount of $72.5 million while waiving the penalties and interest on the principal sum.

0 Comments